$70 Million Owing in Tax

Taxpayers in St.Vincent and the Grenadines owe the Inland Revenue Department (IRD) $70 million in tax arrears.

Kelvin Pompey, Comptroller of the IRD, disclosed this on Monday. {{more}}

The outstanding taxes span the period 1995 to 2006. Pompey firmly believes that collecting at least half of the $70 million is possible.

The Comptroller said the IRD is preparing a list of persons who are not honouring their tax obligations. He told SEARCHLIGHT his department will be working along with these persons and if they fail to pay they can be hauled to court to make them do so, though the IRD has never before taken anyone to court.

For a number of years, said Pompey, the IRD has been using moral suasion to get tax payers to pay up but since this strategy has only resulted in a 60-75 per cent tax compliance level, the penalties will have to be used in order to effect compliance. The IRD is hoping to get the compliance rate up to 90-95 per cent, Pompey anticipates.

âPeople who ignore us, ignore us to their own detriment,â said Pompey, stating, âWe have to toughen up our actâ.

âThis year we want to have a targeted intervention to stop the slide,â Pompey explained.

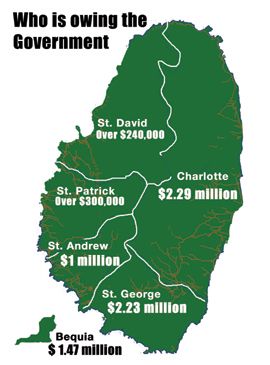

Pompey stressed that the IRD was especially concerned about the amount of monies owing for property taxes. Property owners throughout the country are in arrears to the amount of $8,872,444.96. For example in the parish of Charlotte tax payers are owing $2,218,009.68, St. George $2,226,183.52, Bequia $1,486,694.15 and St. Andrew $1,064,654.16.

âSome people are living in houses and are not even aware that their taxes have not been paid,â said Pompey, adding, âWe are losing millions of dollars each year through defaultersâ.

Pompey stated it is unfair for some persons to carry the countryâs tax burden while others do not.

Pompey stated that during this year the IRD wants to concentrate on compliance because of the high level of tax arrears.

The IRD will also be getting tough on persons who accumulate wealth and cannot for account for it.

Meanwhile, every March month the IRD conducts a public awareness campaign where it sensitizes the public on Income Tax and updates the public about taxation.

March is chosen because taxpayers have until March 31, 2006, to file their Income Tax Returns. After this deadline there will be a 1.5 per cent interest on outstanding taxes as well as a penalty of $20 per month.

As part of this yearâs campaign, the School for Children with Special Needs was painted, members of the department attended a church service at the Hope for Life Ministries on Sunday, March 19, and during the week business houses both on the mainland and the Grenadines were visited as the IRD assisted with the filing of Income Tax Returns. A media outreach programme was staged yesterday and today the IRDâs Annual Exhibition will be showcased downstairs the office of the IRD, and a tax drive will take place tomorrow from Calliaqua to Campden Park and back.